1. The goal: Stop and reverse nature loss.

The world must stop harming nature and reverse the damage already done.

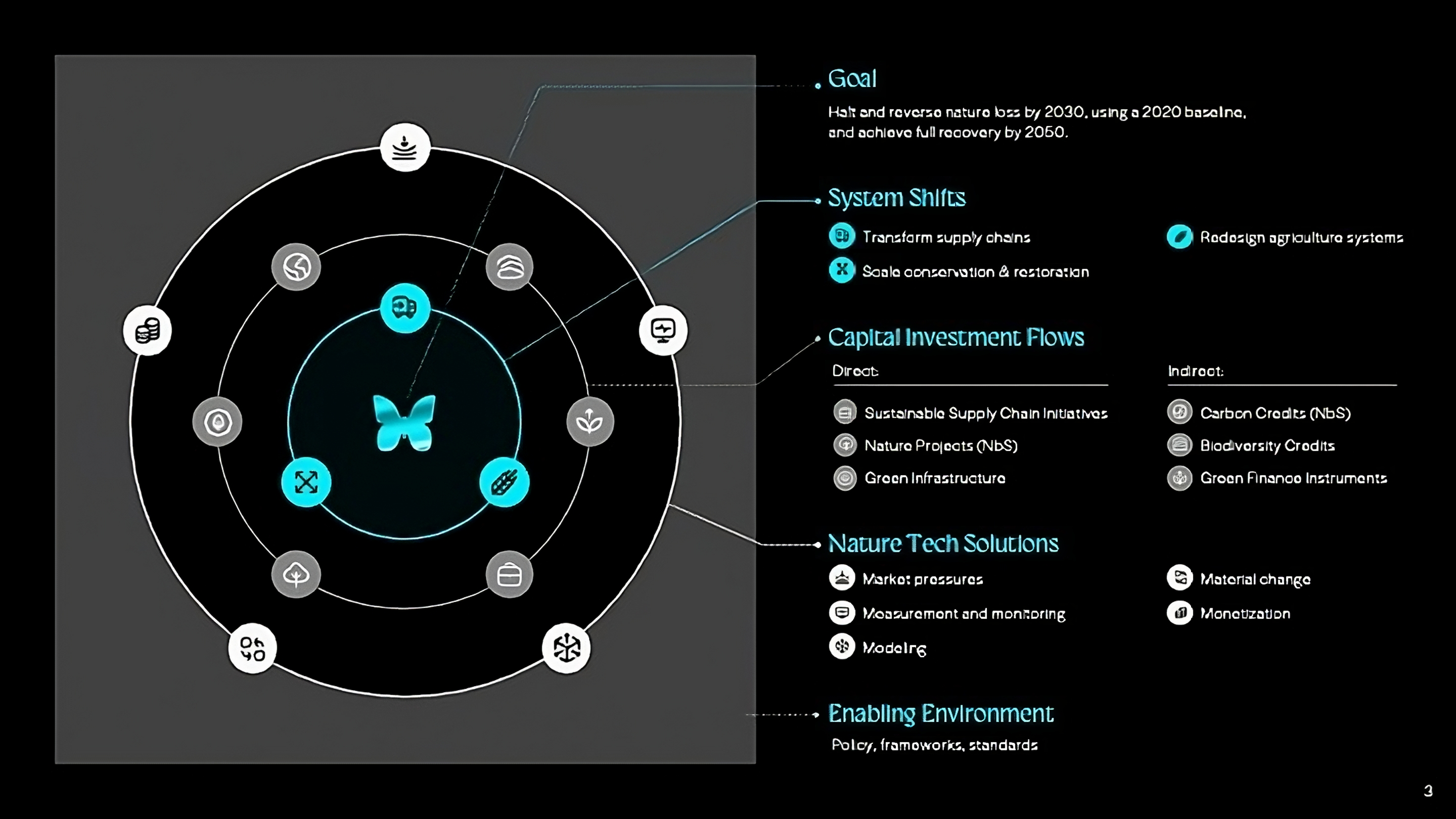

The UN Convention on Biological Diversity (CBD) lays out a clear timeline: halt and reverse nature loss by 2030, using 2020 as a baseline, and achieve full recovery by 2050. This includes protecting biodiversity, restoring ecosystems, and safeguarding essential services like freshwater and raw materials.

The nature-positive transition is the pathway to this goal – a structured, multi-scale, multi-stakeholder effort to stop and reverse damage to nature.

2. There are 3x system shifts required to achieve the nature-positive transition.

Achieving the nature-positive transition requires three system shifts. These shifts are deeply interconnected and must be tackled together to prevent critical gaps in the overall system.

A. Transform Supply

Chains

Key outcomes include eliminating deforestation in key commodities like palm oil, soy, and beef, and adopting circular economy principles by designing out waste and prioritizing reuse.

B. Redesign Agricultural

Systems

Key outcomes include transitioning from industrial farming to regenerative practices, and reducing reliance on harmful pesticides by prioritizing soil health.

C. Scale Conservation and Restoration

Key outcomes include conserving 30% of land, oceans, and freshwater ecosystems by 2030 to protect 80% of global biodiversity, and restoring 30% of degraded land and waters within the same timeframe.

3. The private sector is uniquely positioned to deploy the capital investment required.

Achieving the nature-positive transition requires an estimated $2.7 trillion in annual capital investment, as calculated by the World Economic Forum. Businesses have immense potential to drive investment in nature, mitigating risks and seizing opportunities, with private markets valued at over $10 trillion.

Private capital deployment in nature comes in two forms: direct, and indirect.

Direct investments are often project-based and can include things like specific restoration projects in corporate supply chains, or investment in nature-positive companies by venture capital firms or private equity funds.

Indirect investments involve using financial instruments to influence broader systems and markets, such as purchasing biodiversity credits or investing in green bonds.

A useful way to think about this distinction is that direct investments are akin to “insetting” (direct actions within the value chain), while indirect investments resemble “offsetting”, where investments address impacts outside a company’s value chain. These are not mutually exclusive and are typically used in tandem to achieve outcomes.

4. Nature Tech offers solutions to achieve the nature-positive transition.

Nature Tech drives the transition to a nature-positive economy by enabling innovation across five critical categories, coined by the Nature Tech Collective as the 5Ms. These categories – Market Pressures, Measurement & Monitoring, Modeling, Material Change, and Monetization – help align economic systems with the value of nature and deliver impactful solutions.

Market Pressures solutions align policy, business, and societal goals with nature by addressing market failures and promoting collaboration. They create systems where sustainable practices are not just encouraged, but economically advantageous. For example, supply chain traceability and land titling technologies make supply chains more transparent, empowering consumers to make informed decisions and encouraging businesses to adopt nature-positive practices.

Measurement & Monitoring solutions use digital tools to collect, analyze, and verify nature data, providing the foundation for understanding the impacts of human activities on ecosystems. For instance, remote sensing technologies like those used by Planet Labs provide high-resolution imagery to track deforestation, monitor ecosystem health, and assess biodiversity changes over time.

Modeling turns raw nature data into actionable insights, helping stakeholders prioritize, forecast, and monitor environmental impacts. Advanced analytics platforms, such as IBM’s PAIRS, process and model environmental data to help businesses forecast water risks and identify conservation priorities.

Material Change focuses on tangible interventions that restore ecosystems and transform agricultural and supply chain practices. For example, drone-seeding technologies developed by Dendra Systems make large-scale reforestation projects more efficient, planting seeds in degraded landscapes faster and at scale.

Monetization creates financial incentives for conservation by aligning economic systems with nature goals. For example, Nature Asset Companies (NACs) transform the value of natural ecosystems into financial capital, incentivizing landowners to preserve and enhance natural assets while attracting investment in nature-positive initiatives.

5. Policy, frameworks, and standards make up a critical enabling environment.

Policy, frameworks, and standards make up a critical enabling environment, providing the tools and incentives that drive the private sector to integrate the value of nature into decision-making.

Regulatory measures like the EU’s Corporate Sustainability Reporting Directive (CSRD) exemplify how policy can drive action. By mandating companies to assess and disclose nature-related risks, the CSRD ensures that nature considerations are embedded into business strategies.

Complementing these regulations, voluntary frameworks provide additional pathways for businesses to address nature-related challenges proactively. Initiatives like the Science Based Targets Network (SBTN) and the Taskforce on Nature-related Financial Disclosures (TNFD) help companies set measurable goals for biodiversity, land, water, and climate. These frameworks often act as a bridge between global policy objectives and actionable business strategies, encouraging organizations to act ahead of regulations or in regions where mandates are not yet in place.

To ensure these regulatory and voluntary frameworks translate into meaningful action, standards provide a critical layer of support. They standardize implementation by offering consistent methodologies and metrics for businesses to follow. For example, companies reporting under the CSRD rely on the European Sustainability Reporting Standards (ESRS) to ensure disclosures are clear, comparable, and aligned with the EU taxonomy.

This enabling environment helps businesses navigate the complexity of nature-related risks and align their actions with global goals, accelerating the transition to a nature-positive future.