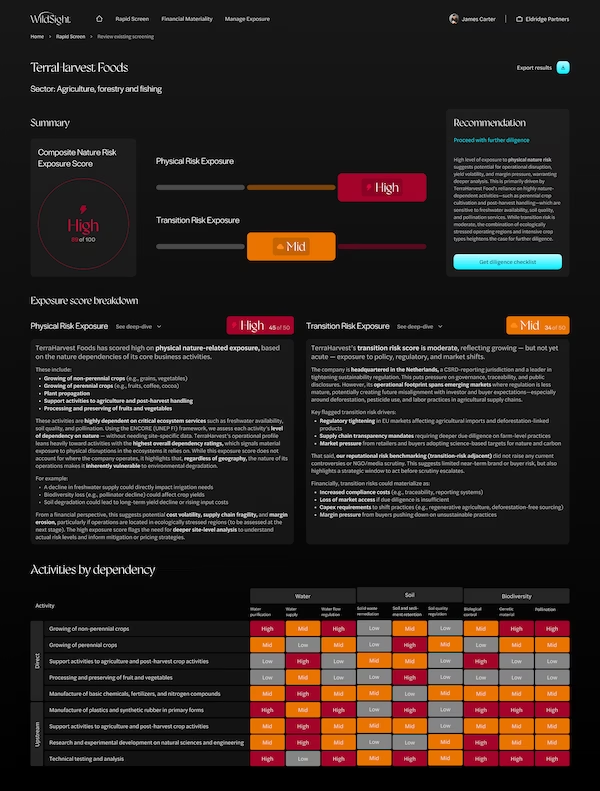

01. Rapid screen for nature risk exposure.

Get an on-demand view of a target company’s nature-related risk, so you can deepen diligence or prioritize portfolio intervention where it counts.

We screen companies using a composite nature risk exposure score, powered by AI-driven models that monitor regulatory, reputational, and ecosystem dependency risks (direct and upstream) in real-time.

02. Assess financial materiality.

For entities with high nature risk exposure, we convert nature risk to financial risk and assess materiality.

Our models map site and sourcing footprint to size EBITDA at risk from physical and transition drivers, using globally recognized geospatial datasets including BII, GLASOD, IBAT, CDP.

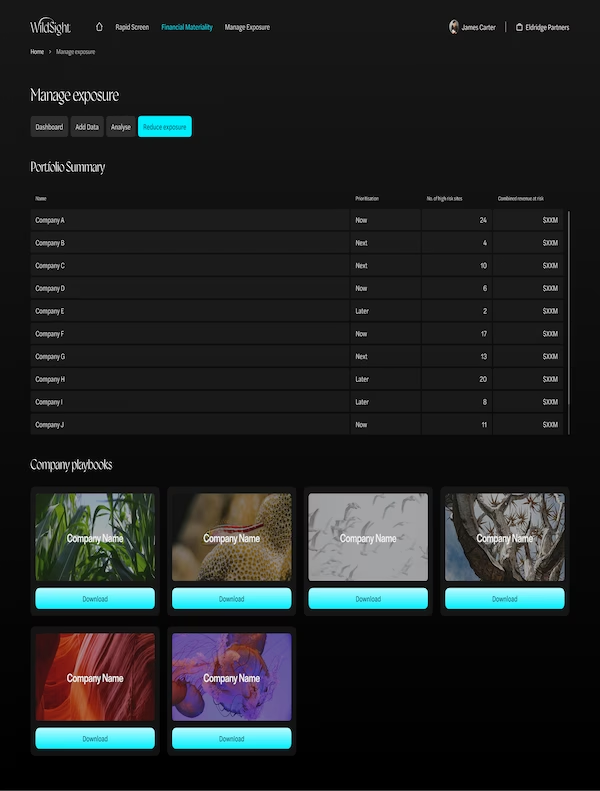

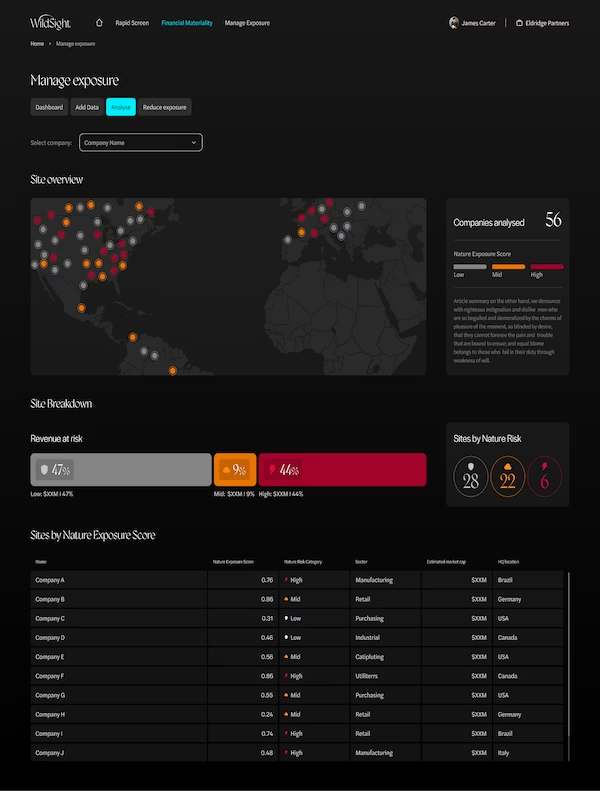

03. Manage nature risk during hold.

Triage your portfolio to identify where nature risk exposure is concentrated.

We match priority risks to interventions, and tailor based on factors like strategic fit and feasibility.

The result is an action playbook, with interventions sequenced over time and tied to estimated ROI and guidance on implementation and KPIs.

Built for dealmakers, different by design.

We get to the ‘so what’ with clear recommendations linked to financial materiality.

We get to the ‘so what’ with clear recommendations linked to financial materiality.

We start with red flags, then go deeper only where risk demands it – nothing generic, nothing wasted.

We start with red flags, then go deeper only where risk demands it – nothing generic, nothing wasted.

We cover all nature risks - not just biodiversity - and turn data into actionable next steps.

We cover all nature risks - not just biodiversity - and turn data into actionable next steps.